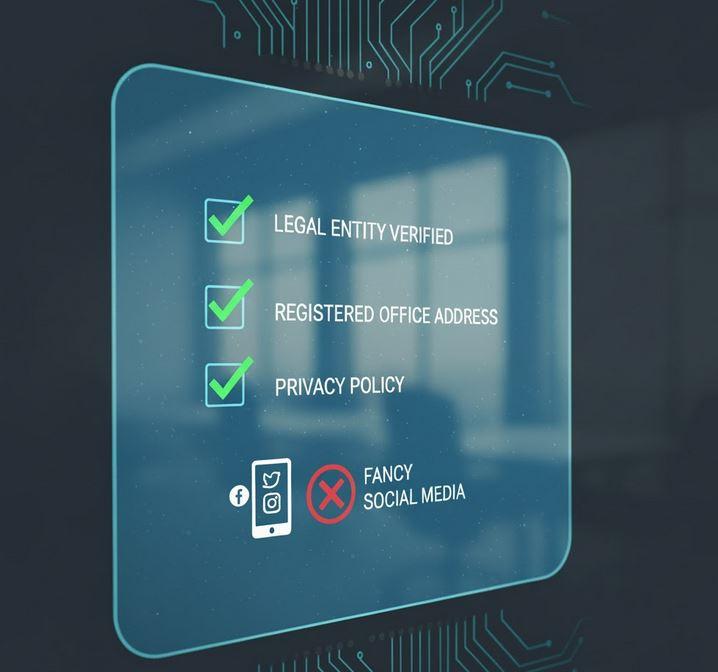

Choosing a payment provider is one of the most critical decisions for your business. It isn't just about transaction fees or fancy features; it’s about trust and legal safety. Many providers use slick marketing to hide a lack of formal structure.

In this blog post, we will guide you through the key aspects of selecting a secure payment provider. From verifying the legal name to understanding the significance of a transparent privacy policy, we'll help you navigate the essential checks that go beyond superficial online impressions. While a flashy Facebook or Instagram account can be enticing, it's vital to recognize the importance of thorough research to ensure your chosen provider meets the highest security standards.

Here is how to peel back the curtain and ensure your money (and your customers' data) is in safe hands.

1. Unmask the Legal Entity

It sounds basic, but many "fly-by-night" payment gateways operate under a brand name without ever disclosing their Registered Legal Name.

- Why it matters: If a dispute arises or funds are frozen, you cannot take legal action against a "brand name." You need a registered company (e.g., Example Payments Ltd).

- Where to look: Don't just check the homepage. Scour the Terms & Conditions (T&C) or the footer of the website. If they don't explicitly state "This service is provided by [Legal Name]," walk away.

- The Pro Move: Once you have the legal name, verify it on government registries.

2. Verify the Registered Office Address

A "Contact Us" page with a generic email form is a red flag. A legitimate financial provider must have a physical, registered office address.

- The Trap: Some providers use "Virtual Offices" (basically a P.O. box or a shared mail drop) to appear local.

- The Verification: Search the address on Google Maps. If the "headquarters" of your payment provider is a suburban house or a tiny co-working cubicle in a different country than they claim to be in, they likely lack the infrastructure to protect your business.

3. Scrutinize the Privacy Policy

A secure provider doesn't just say "we protect your data"—they tell you exactly how.

- Check for Compliance: Look for mentions of GDPR (Europe), PCI DSS (Payment Card Industry Data Security Standard), or CCPA (California). A provider without PCI DSS Level 1 certification is a non-starter.

- Data Sharing: Read the section on "Third Parties." Secure providers limit data sharing to essential banking partners. If their policy allows them to sell "anonymized data" to marketers, your customers' privacy is at risk.

4. What NOT to Check: The "Social Media Trap"

It is tempting to trust a provider because they have 50,000 followers on Instagram or a "verified" Facebook page with high-quality lifestyle photos.

Warning: A fancy social media account is a marketing expense, not a security feature.

- Followers can be bought: Don't let a high follower count cloud your judgment.

- Aesthetics ≠ Security: Beautifully designed ads do not mean they have robust encryption or anti-fraud protocols.

- The Ghost Support: Check their "Comments" section. If you see dozens of unanswered complaints about "missing funds" or "frozen accounts," that’s the reality behind the filtered photos.